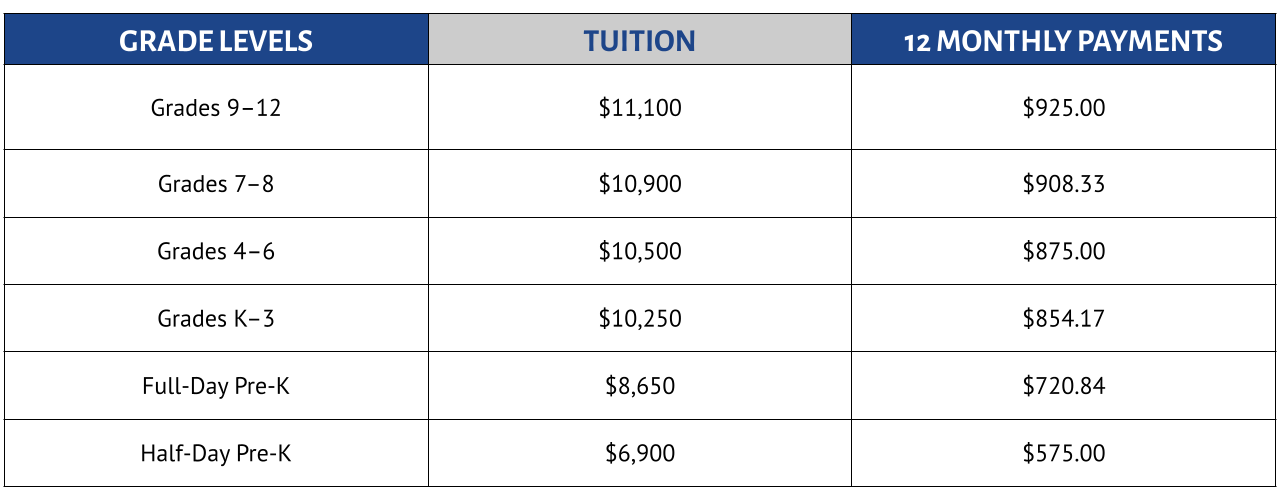

Tuition

How much is tuition?

At Christian Heritage Academy, we strongly believe that Christian education is not a luxury but a necessity in today’s world. We would like the opportunity to help you meet your children’s spiritual and educational needs by offering a Biblically-based and academically robust education that is consistent with our school’s vision and mission.

Parental Choice Tax Credit

What is the Oklahoma Parental Choice Tax Credit program?

The Parental Choice Tax Credit program provides a refundable income tax credit of $5,000-$7,500 for eligible Oklahoma taxpayers who pay, or expect to pay, qualified expenses such as tuition and fees to an eligible private school on behalf of an eligible student that attends or plans to attend an eligible private school during that tax year.

How do I apply for the Parental Choice Tax Credit?

The Oklahoma Tax Commission (OTC) has made a few changes to the process for families to apply for the tax credit. The new website for the Oklahoma Parental Choice Tax Credit is https://www.parentalchoice.ok.gov/. One of the featured links on the website is the Program Handbook, a comprehensive guide containing details regarding the Oklahoma Parental Choice Tax Credit program and the application process to apply for the tax credit. The following is a synopsis of the application process. The updated information is bold.

The Oklahoma Tax Commission has partnered with Merit International, Inc. to administer the Parental Choice Tax Credit program. Merit will serve as the program management platform for participating families and schools by reviewing applications, verifying eligibility, issuing digital access credentials, and managing customer support and marketing outreach.

The tax credit is for the 2024 tax year — the second semester of the current school year 2023–2024 (January 2024–May 2024) and the first semester of the 2024–2025 school year (August 2024–December 2024).

- Each family will complete a single application for all of their students enrolled in a private school for the 2023–2024 school year, for students' families who are planning to re-enroll for the 2024–2025 school year, and for any NEW students' families who are planning to enroll for the 2024–2025 school year.

- Applications are available December 6 at 2:00 pm.

- Priority consideration is from December 6, 2023–February 5, 2024 for families whose adjusted gross income (AGI) is from $0–$150,000.

- If funds remain after families mentioned above, families whose AGI is above $150,000 may be approved to receive the tax credit. Consideration for these applications will be in the order of submission, so apply early.

Families will use information from their Federal Income Tax Return Form 1040. Use the hyperlink to view a sample of form 1040 with the sections highlighted that you will need to complete the application for the tax credit.

Required Information

- Name, address, and social security number (SSN) or individual taxpayer identification number (ITIN) of the taxpayer

- The name, address, date of birth, and SSN or ITIN of the eligible student(s)

- The name and address of the eligible students' parent(s) or legal guardian(s), if different from the taxpayer

- Verification of federal AGI for 2022

How to Claim the Tax Credit

- To expedite the preparation of the Enrollment Verification form and net tuition for each student in a family, submit this Verification of Enrollment web form to notify the Office of Admissions that you will apply for the tax credit. Schools will send the information gathered from the Verification of Enrollment forms for each child to Merit. Merit will use the information uploaded by schools to generate verification forms for each family and Merit will email those forms to each family.

- Complete an application online. The OTC and Merit expect applications will be available by December 6, 2023.

- Submit the application.

How Payments Are Issued

Merit sends the installment payments with individual warrants (a check) made payable to the taxpayer and mailed to the private school where the eligible student is enrolled or expected to enroll. The taxpayer shall restrictively endorse the warrant to the private school for deposit into the account of the school. CHA will apply the funds to the family’s FACTS financial account or issue a refund if the family has already paid the tuition.

Scholarship Opportunities

Opportunity Scholarship Fund (OSF)

Recognizing that money does play a role in your family’s education, and that tuition is an investment into the lives of your children, Christian Heritage Academy offers a needs-based tuition scholarship program through OSF. Please contact the Office of Admissions at (405)672-1787, ext. 202 to discuss the application process for an OSF scholarship.

Lindsey Nicole Henry Scholarship (LNHS)

Christian Heritage Academy is an approved private school by the State Department of Education to receive scholarships through the Lindsey Nicole Henry Scholarship fund. Visit their website to determine eligibility and access an application. CHA does not have access to the applications for the LNHS. LNH notifies the family first and then CHA when a family is awarded a scholarship.

Folds of Honor (FOH)

Folds of Honor provides scholarships for students from military families and students from first-responder families. Visit their website to determine eligibility and access an application. FOH accepts applications between February 1–March 31 each year. CHA does not have access to the applications for families. FOH notifies the family first and then CHA when a family is awarded a scholarship.

Fees

Fees are non-refundable. (See "Enrollment Agreement" section below for details pertaining to one exception.)

Additional Student Discounts

Discounts listed below are applicable for additional full-day students only. A half-day student who is the 4th or additional child enrolled will qualify for a $250 tuition discount. Discounts are to be deducted from the additional child(ren)’s tuition amount(s) as listed above.

Active-Duty Military / Pastoral Ministry Discounts

We offer tuition discounts for active-duty military personnel and local church pastoral ministry families. Please contact the Office of Admissions for more information.

Payment Plans

- Three options are available for payment of tuition.

- Monthly checking/savings account ACH draft, paid online: Tuition is divided into twelve monthly, interest-free payments. The first payment will be drafted June 16, 2024; the final payment is drafted May 16, 2025.

- Semester payment plan (includes $50 discount per payment, per full-day student only), paid online: 50% of tuition will be drafted June 2, 2024; the second payment will be drafted December 2, 2024: Families can make a payment before either due date. (Discount is forfeited if the payment is late.)

- Annual payment plan (includes $150 discount per full-day student), paid online: 100% of tuition will be drafted June 2, 2024. (Discount is forfeited if the payment is late.)

- Once families establish a payment plan, they can make payments before June 2024. Please contact the Director of Business to create the new schedule.

- If there are times of financial difficulty, please contact the Director of Business to discuss arrangements for payment.

- If any part of tuition becomes more than 30 days overdue, the STUDENT(S) may not be admitted to class until satisfactory arrangements are made with the Director of Business.

- Tuition accounts must be current at the end of the first semester for students to attend classes the second semester.

Enrollment Agreement

- Concerning financial obligations, students may not attend class until the fees (application and enrollment fee for new students; enrollment fee for returning students) have been paid and the tuition is current.

- As part of the contract for enrollment, each family agrees to the terms delineated in the contract. Please carefully read the Withdrawal Form regarding terms for withdrawal, fees associated with withdrawing students, and possible refunds. The policy is designed to ensure judicious financial planning and to protect the school from unexpected financial loss.

- Fees are non-refundable. The exception: new students will receive a refund of the enrollment fee if the enrollment process is not completed.