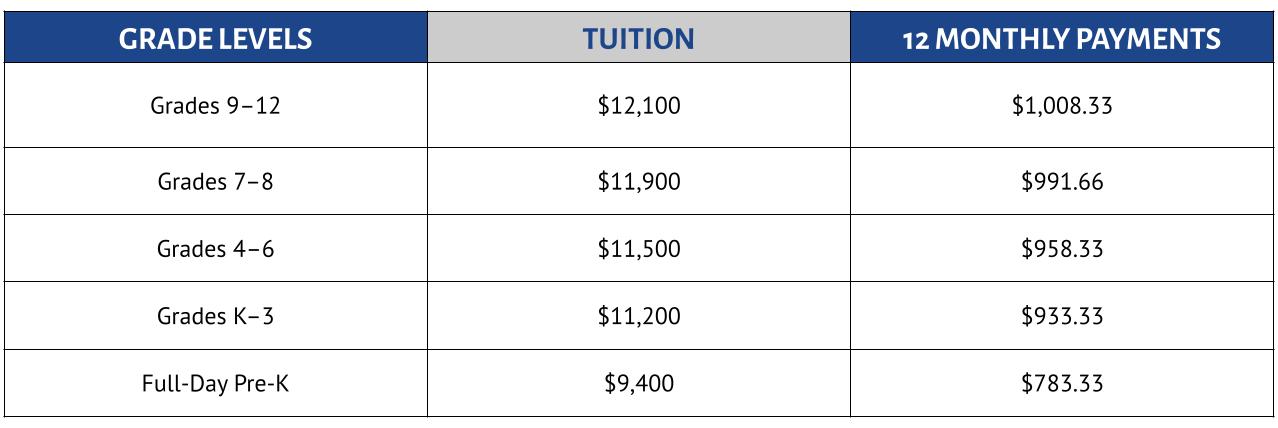

Tuition

How much is tuition?

At Christian Heritage Academy, we strongly believe that Christian education is not a luxury but a necessity in today’s world. We would like the opportunity to help you meet your children’s spiritual and educational needs by offering a Biblically-based and academically robust education that is consistent with our school’s vision and mission.

Parental Choice Tax Credit

What is the Oklahoma Parental Choice Tax Credit program?

The Parental Choice Tax Credit (PCTC) program provides a refundable income tax credit of $5,000–$7,500 for eligible Oklahoma taxpayers who pay, or expect to pay, qualified expenses such as tuition and fees to an eligible private school on behalf of an eligible student that attends or plans to attend an eligible private school during that tax year.

Parental Choice Tax Credit (PCTC) Meetings

Christian Heritage Academy is hosting two PCTC meetings. The first meeting is Thursday, September 18, 2025, and the second meeting is Thursday, January 8, 2026. We are offering several times during the day on each date to allow flexibility to attend. RSVP through this Google form.

At the September meeting, the guidelines for the remainder of the 2025-2026 school year will be reviewed, and information will be shared about how CHA applies the tax credit to financial accounts for tuition along with enhancements to the PCTC law for the 2026-2027 school year. If you have any questions, please contact Mrs. Darcel Small, Director of Admissions or Mrs. Teresa Johnston, Admissions Assistant, (405) 672-1787 or admissions@cha.org.

OTC Resources

Helpline: (405) 521-3160

Parental Choice Tax Credit—Here's How It Works

Parental Choice Help Center—FAQs

Scholarship Opportunities

Opportunity Scholarship Fund (OSF)

Recognizing that money does play a role in your family’s education, and that tuition is an investment into the lives of your children, Christian Heritage Academy offers a needs-based tuition scholarship program through OSF. Please contact the Office of Admissions at (405)672-1787, ext. 202 to discuss the application process for an OSF scholarship.

Lindsey Nicole Henry Scholarship (LNHS)

Christian Heritage Academy is an approved private school by the State Department of Education to receive scholarships through the Lindsey Nicole Henry Scholarship fund. Visit their website to determine eligibility and access an application. CHA does not have access to the applications for the LNHS. LNH notifies the family first and then CHA when a family is awarded a scholarship.

Folds of Honor (FOH)

Folds of Honor provides scholarships for students from military families and students from first-responder families. Visit their website to determine eligibility and access an application. FOH accepts applications between February 1–March 31 each year. CHA does not have access to the applications for families. FOH notifies the family first and then CHA when a family is awarded a scholarship.

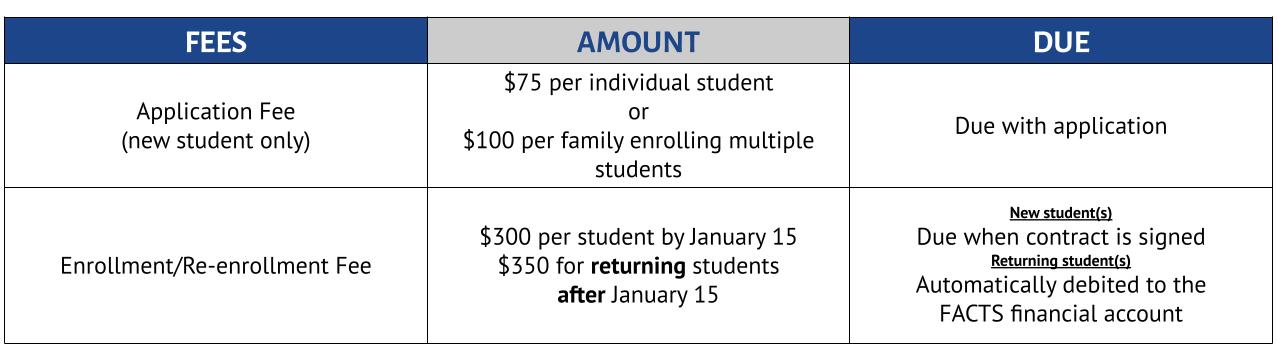

Fees

Fees are non-refundable. (See "Enrollment Agreement" section below for details pertaining to one exception.)

Active-Duty Military / Pastoral Ministry Discounts

We offer tuition discounts for active-duty military personnel and local church pastoral ministry families. Please contact the Office of Admissions for more information.

Payment Plans

- Three options are available for payment of tuition.

- Monthly checking/savings account ACH draft, paid online: Tuition is divided into twelve monthly, interest-free payments. The first payment will be drafted June 16, 2026; the final payment is drafted May 16, 2027.

- Semester payment plan, paid online: 50% of tuition will be drafted June 16, 2026; the second payment will be drafted December 16, 2026. Families can make a payment before either due date.

- Annual payment plan, paid online: 100% of tuition will be drafted June 16, 2026.

- Once families establish a payment plan, they can make payments before June 2026. Current families have the same payment plan as the previous school year. Please contact the finance department to create the new schedule.

- If there are times of financial difficulty, please contact the finance department to discuss arrangements for payment.

- If any part of tuition becomes more than 30 days overdue, the STUDENT(S) may not be admitted to class until satisfactory arrangements are made with the Director of Finance.

- Tuition accounts must be current at the end of the first semester for students to attend classes in the second semester.

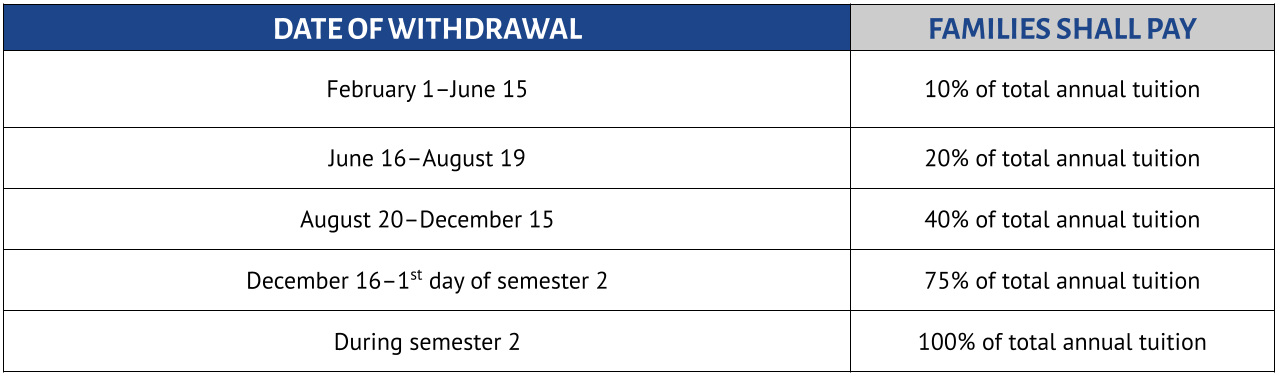

Enrollment Agreement

- Concerning financial obligations, students may not attend class until the fees (application and enrollment fee for new students; enrollment fee for returning students) have been paid and the tuition is current.

- As part of the contract for enrollment, each family agrees to the terms delineated in the contract. Families must sign the enrollment agreement each year. Please carefully read the Withdrawal Form regarding terms for withdrawal, fees associated with withdrawing students, and possible refunds. The policy is designed to ensure judicious financial planning and to protect the school from unexpected financial loss.

- Fees are non-refundable. The exception: new students will receive a refund of the enrollment fee if the enrollment process is not completed.